Any business that makes bulk payments (also called mass payments, batch payments, and so on) on a regular basis knows how daunting the task is.

Whether it’s employee salaries, vendor payments, or partner commissions, these payments have to be error-free and made on time to maintain amicable working ties with each member involved, and the process of planning, executing, and tracking each payment takes a lot of time and effort.

Fortunately, there is a solution specifically designed to digitize and automate mass payments, called bulk payouts. This article will explain:

- what a bulk payout solution is

- how it’s being used in real-world scenarios

- how you can implement a bulk payout solution for your business

What is a bulk payout?

Businesses make bulk monetary transfers on a regular basis for employee salaries, vendor settlements, bill payments, etc. Traditionally, these mass or bulk transfers were performed manually, with each invoice and transaction being processed individually. This is undoubtedly a time-consuming and cumbersome task and absolutely not necessary in today’s digital age. Modern banking services have made it easier to automate bulk transfers using APIs.

Using direct bank transfers, however, has its own drawbacks. Implementing bank APIs is challenging, adding beneficiaries takes time, payment methods are limited, the business is dependent on the bank’s working hours and IT processing capabilities, etc.

FinTech bulk payout solutions have been developed to solve the problems in traditional methods of making bulk payments. Today’s digital solutions make bulk payouts fast, secure, affordable, and scalable.

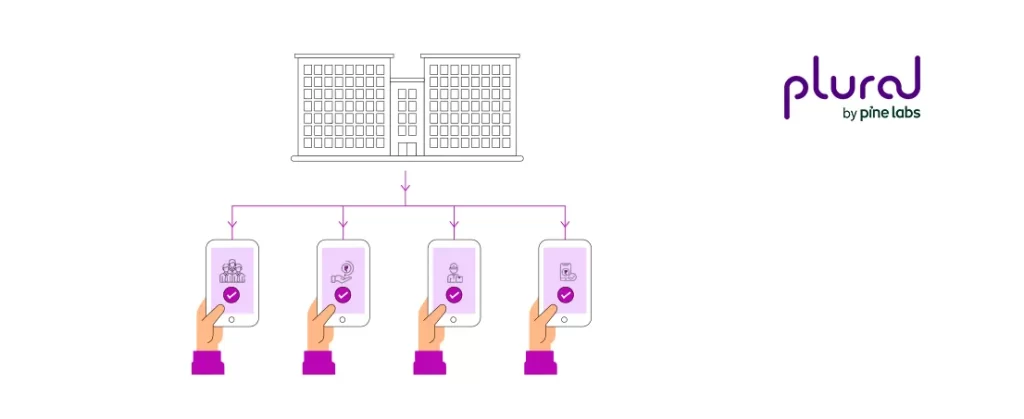

A ‘bulk payout’ is a payment made from a single account owned by a company or a person to multiple beneficiaries, all in one go. The payment goes through in a single transaction and shows as a single debit item in the sender’s bank statement.

Bulk payout solutions handle the time and security-sensitive processes involved in making a bulk payout (like verifying individual account details, checking account statuses, initiating refunds, etc.) instead of the bank and are thus able to process these payments instantaneously.

Integrating payment APIs into your business application is quick and easy, so you get the benefit of efficient bulk payouts without the hassle of complex development.

Bulk payout use-cases

Employee Salaries

Paying employee salaries is the foremost use of bulk payouts for businesses.

A company with hundreds of employees needs to ensure that each employee receives their salary on time — it’s important for the employee and for the company’s reputation. Bulk payouts are an elegant solution for this scenario. The bulk payment can be scheduled, automated, and forgotten.

Vendor payments

Similar to employee salaries, vendor bills need to be paid on time to maintain amicable professional ties and for the business to continue unabated.

Bulk payouts help you stick to a fixed payment schedule or run them instantly in real-time and manage all vendor payments through one transaction.

Marketplace transactions

E-commerce marketplaces like retail store aggregators need to split and disburse single customer payments to multiple vendors instantly. These transactions happen in large volumes every minute, making the task all the more challenging.

Automating these payments is difficult because they are of different amounts and to different vendors, and making these payments manually is just going to be time-consuming.

Bulk payout solutions solve this challenge by automatically splitting the incoming payment and routing them to the right vendors.

Refunds

Refunds are a part of any online business, especially high-volume e-commerce stores.

To maintain customer trust and satisfaction, refunds have to be disbursed instantly from the store’s end (while the bank might take a few business days to deposit it to the customer’s account).

The challenge with refunds is handling the volume (the average refund rate for e-commerce businesses is 18 percent) and the variation in amounts — some refunds are full and some are partial.

Bulk payout solutions can be used to instantly initiate refunds of all amounts and types and also to manage bulk refunds through a user list.

Cashback and offers

Similar to refunds, cashback and other similar offers that give the customer a percentage (or fixed sum) of their payment back as a reward need to be instantaneous and seamless.

The challenge is to instantly execute multiple cashback returns happening simultaneously, and bulk payout solutions can handle this scenario adeptly.

Rewards and contests

A business running a contest that has a monetary prize will need to disburse cash rewards to winners in bulk. The same goes for online gaming platforms that involve actual money.

Such platforms need to initiate instant transfers when a user triggers a withdrawal from their account wallet, and this often happens in bulk as multiple users initiate withdrawals simultaneously. A bulk payout app helps automate and manage these transactions.

The Benefits of using a bulk payout solution

1. Saves time for execution and management

Making high-volume payments is a time and resource-intensive task. With conventional methods, you need to add beneficiaries, manage accounts, etc.

Bulk payouts enable you to upload a bulk list and schedule these payments to be executed in one go, automatically. This ensures all recipients receive their payments on time while minimizing your responsibility to just creating a list and scheduling single events.

2. Enhanced security

Bulk payout solutions adhere to bank policies and security measures and also have added layers of security like data encryption. This system ensures your data and money is safe from threats.

3. Supports business scalability

Adding and removing accounts from the bulk list is a simple matter of editing the list or using the solution’s dashboard.

A scaling business does not need to worry about managing payments (to employees or vendors) because they don’t need to create new beneficiaries or payment tasks; they just need to edit the bulk list.

4. Better ROI

Bulk payout solutions enable businesses to automate payment tasks like making bulk payments, calculating fees, managing rewards, etc. This frees up your accounting and tech teams to work on other important tasks.

When you measure the cost of manually managing all these tasks vs. the cost of implementing a bulk payout solution, you’ll notice the ROI is much higher for a bulk payout solution.

5. Supports cross-border transfers

Borders are all but imaginary in the world of business. A business can have employees working remotely, vendors delivering services, and customers purchasing products — all from different parts of the world.

Managing cross-border bulk transfers to all of these people using conventional methods will not just be time and effort-consuming; it may end up costing you more in terms of fees. Instead, you can use bulk payouts to manage cross-border payments and the cost of making these payments.

6. Lowers payment failure rate

There are many reasons for payment failures when it comes to bulk transfers — invalid account information, unsupported payment methods, issues with the bank, etc. These errors sometimes cause the entire bulk transfer to fail when using conventional methods.

Additionally, tracking which payments have gone through, which ones have failed, and the reason for failure is also challenging with conventional methods.

Bulk payout solutions follow the process of verifying each account before initiating the transfer, and in the case of invalid accounts or other potential reasons for a failure, skip the account and continue with the bulk payment. They also maintain a log of failed payments and the reason for failure so you can take appropriate corrective action.

7. Supports multiple payment options

Bulk payout systems support different payment methods like bank transfers, credit card refunds, UPI payments, transfers to digital wallets like Google Pay, etc.

You don’t have to worry about limited payment options and can make bulk payments to multiple people using different methods, all in one go.

Implementing a bulk payout solution

Bulk payout systems are merchant-friendly solutions that help businesses manage, operate, and track all bulk payments from a single dashboard. Implementing these APIs into your business is easy, and you can begin making bulk payments in a matter of minutes.

If you’re looking to implement a bulk payout solution, try Plural, our bulk payout solution that is trusted by over a hundred leading brands.

Plural’s payout solution is built for BIG!

Plural Payouts features include:

- Bulk transfers and instant transfers

- A detailed dashboard with in-depth analytics and data

- Multiple payment modes: Pay to bank, UPI, card and wallets

- Payout links: Share Payout links with customers, vendors and partners who can add their bank/UPI details and receive payouts instantly.

- Maker-checker flow: Eliminate transactional risks by enabling a maker-checker flow

- Split payments: Split marketplace payments to multiple vendors or stakeholders

At present, Plural Payouts is available as a dashboard solution but will soon be available with APIs. Look out for easy-to-integrate, developer friendly APIs to make 24*7 refunds and payouts to customers, partners and vendors with better UX — COMING SOON!

Also coming soon are low-code and no-code solutions to help your business!

Want to get in touch with us? Reach us at pgsupport@pinelabs.com.

Plural by Pine Labs has received an in-principle authorisation from the Reserve Bank of India (RBI) to operate as a Payment Aggregator.

Amrita Konaiagari is a Marketing Manager at Plural by Pine Labs and Editor of the Plural blog. She has over 10 years of marketing experience across Media & Tech industries and holds a Master’s degree in Communication and Journalism. She has a passion for home décor and is most definitely a dog person.