Big Purchases Made

Possible with Plural’s

Affordability Suite

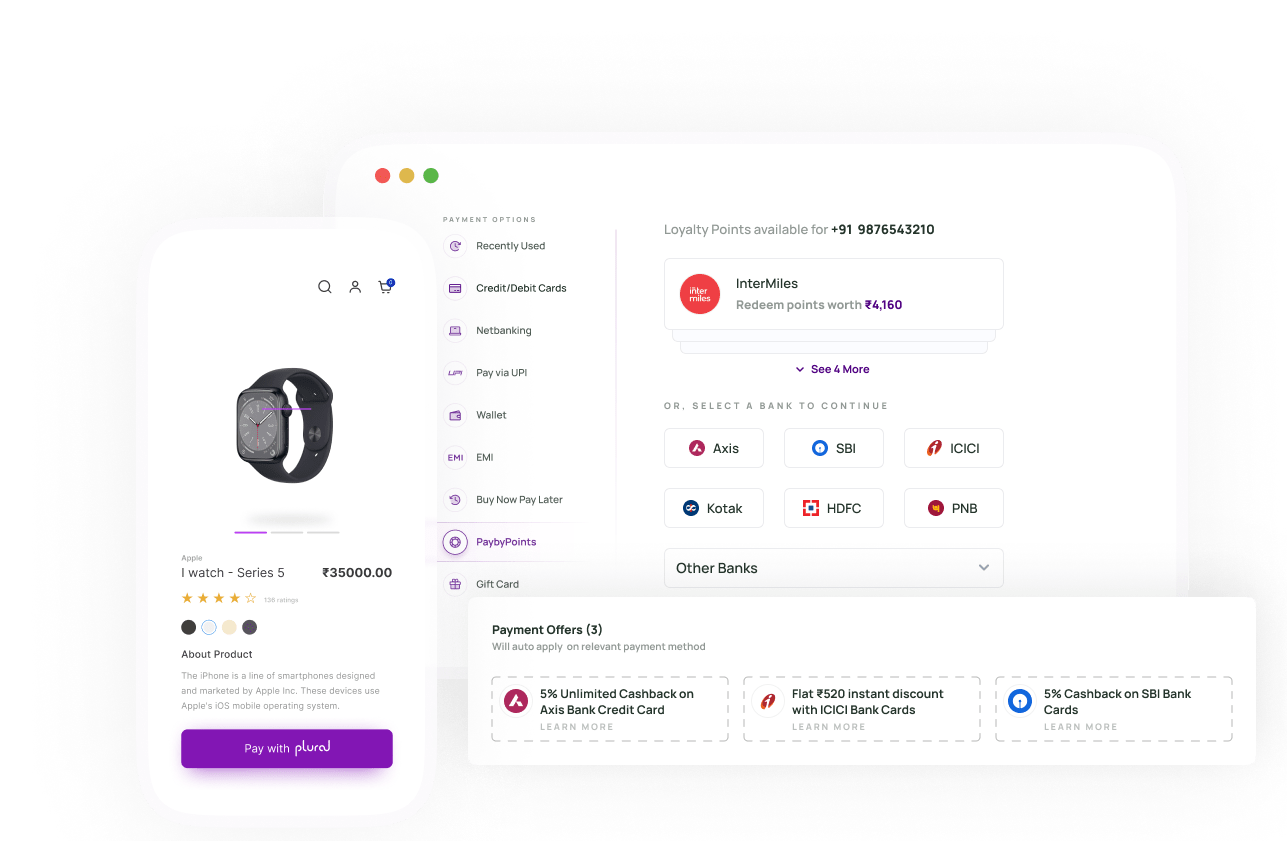

A Host of Payment Options to Boost Sales

No/low cost EMI

A zero interest EMI option guaranteed to get entice your customers

Credit card EMI

Offer EMI options to the 66 million credit card users in just 1 step with Plural’s Affordability Suite

Brand EMIs

An industry-first offering to boost sales on 25+ brands

Discounts, cashback, and offers

Provide customized offers at the click of a button using Plural’s dashboard and APIs

Debit card EMI

Tap into the 940 million active debit card users in India by offering EMIs on debit cards!

Cardless EMI

No card? No problem. Plural’s Affordability Suite allows you to offer EMIs to customers without debit and credit cards!

Buy Now Pay Later

Enable customers to make purchases now without the burden of immediate payment

Benefits of Plural’s Affordability Suite

Plural Promotions Engine and Brand EMIs

Our Library

Harness the power of affordability to boost revenue & expand customer base

Last week my husband and I were looking to purchase a television online. My husband was keen on making…

Reliance Digital adds tremendous growth in revenue with Plural’s Affordability Suite

At Plural, we’re constantly striving to do better for our customers — be it through service, products…

10 ways to prepare your eCommerce store for the festive season

With the Diwali season upon us, and Black Friday, Cyber Monday, Christmas, and New Year close by…

Frequently Asked Questions

How can users use Cardless EMI on website/app?

Cardless EMIs are a completely digital payment option that allow customers to make payments in instalments without a physical credit or debit card. Cardless EMI is available as a payment method on checkout. To enable Cardless EMI for your website / app, please connect with us to raise a request.

What is debit card EMI vs credit card EMI?

When making a purchase, customers can choose to convert their payment into equated monthly instalments (EMIs) either through debit cards or credit cards. Debit cards are linked to customers’ savings account. When customers make a purchase through the debit card EMI option, the money is first debited from their savings account and subsequently reversed in two working days. As long as there are sufficient funds to make the purchase, one can opt for the debit card EMI.

Whereas with credit card, the card holder is assigned a pre-determined credit limit as a short-term loan by the credit card issuing company. In the credit card EMI option, customers are required to pay interest on the outstanding amount till the EMI is cleared.

What is the difference between EMI & PayLater?

Equated monthly instalments (EMIs) are payment options that allow customers to break up the total purchase value into easy instalments to be paid over a period of time.

Pay Later is a credit line or a loan account that allows customers to make a purchase in the present and pay the full amount at a later date.