Equated Monthly Instalments (EMI) serve as a flexible payment option that allows consumers to break up the price of a purchase into smaller, manageable monthly payments. Payment gateways partner with financial institutions to facilitate these EMI transactions, providing both merchants and consumers with a seamless and convenient payment experience.

Brand EMI takes this a step further by offering specialized EMI plans that are co-created by the brand itself, often in partnership with financial institutions. This not only allows for more customized repayment terms but also provides exclusive offers and benefits tied to the brand, thereby enhancing customer loyalty and increasing sales for the brand and the merchant alike.

The Benefits of EMI

For consumers

- Affordability: Brand EMI makes high-ticket items more accessible.

- Flexibility: Customized repayment options to suit individual needs.

- Exclusive offers: Special discounts or add-ons that come with choosing EMI as a payment option.

For brands

- Increased sales: Easier financing options often lead to higher sales volumes.

- Customer loyalty: Offering a seamless financing solution can enhance brand loyalty.

- Market differentiation: A well-structured Brand EMI can set a brand apart from its competitors.

- Higher transaction value: Offering Brand EMI can encourage customers to opt for higher-value products, increasing the average transaction value.

- Reduced Risk: With financial institutions handling the credit risk, merchants can focus on their core business.

For Merchants

- Enhanced customer experience: Providing multiple payment options, including Brand EMI, improves the overall shopping experience.

- Competitive advantage: Merchants offering Brand EMI can stand out in a crowded marketplace, attracting more customers.

- Streamlined operations: Partnering with fintech solutions like Plural by Pine Labs can make the implementation and management of Brand EMI schemes hassle-free

The Complexity of Managing Brand EMI

Managing Brand EMI offers a host of advantages but comes with its own set of intricate challenges. Here’s a breakdown:

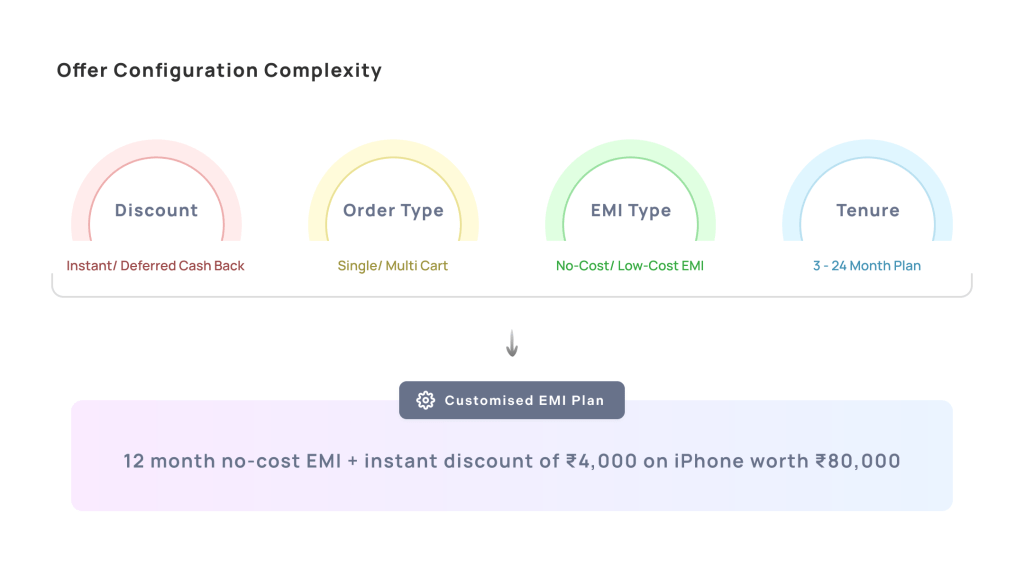

Offer configuration

- Flexibility: The complexity in offer configuration arises from the multitude of variables involved, such as cashback type, order type, subvention type, EMI type, card type, issuer type, funding combination, tenure, and customized subvention plans. Each variable offers multiple options, making the configuration process intricate and demanding.

- Activation TAT: The Time to Activate (TAT) for offers is often extended due to the complex configuration process, leading to missed sales opportunities.

- Manual errors: Some steps in the offer configuration are offline, making the process vulnerable to manual handling errors.

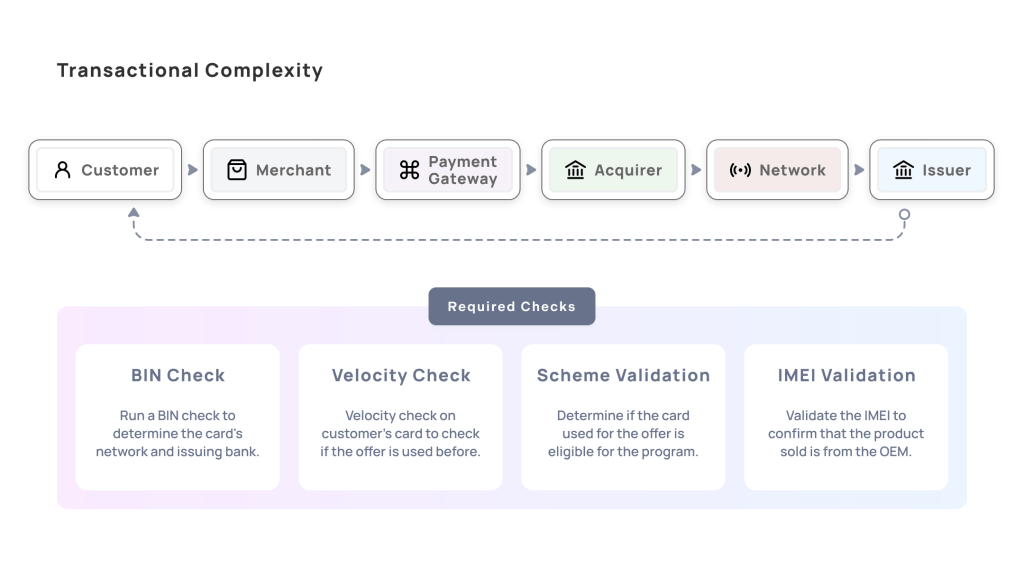

Customer Check-Out

- Offer discovery: Customers face challenges in discovering the most beneficial offers available to them.

- Cognitive load: The complexity of identifying, understanding, and applying the best offer can be overwhelming for customers.

- Checkout UX: The user experience during the checkout process is often suboptimal, with issues like unclear error messages and unexciting UI designs

Post-Transaction Support

- Offers dashboard: Brands lack a real-time view into the performance of their offers, including transaction statuses and attributes.

- Offline support: Customer queries are often managed via email, making it easy to lose track despite existing SLAs.

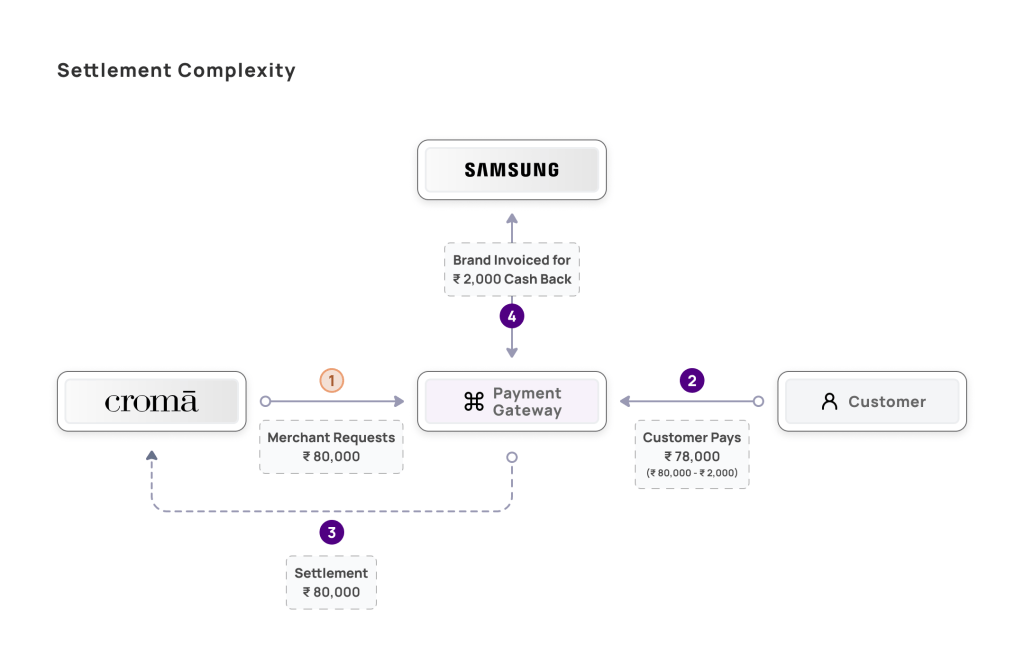

- Settlements visibility: Merchants, especially those not on the ICB T+1 model, struggle with cash flow visibility.

- Transaction visibility: Real-time or near-real-time data on transactions and offers is often lacking, hindering agile decision-making.

- Integration issues: There are no real-time alerts for brands or merchants if offers are not rendered correctly during checkout, leading to missed opportunities and customer dissatisfaction.

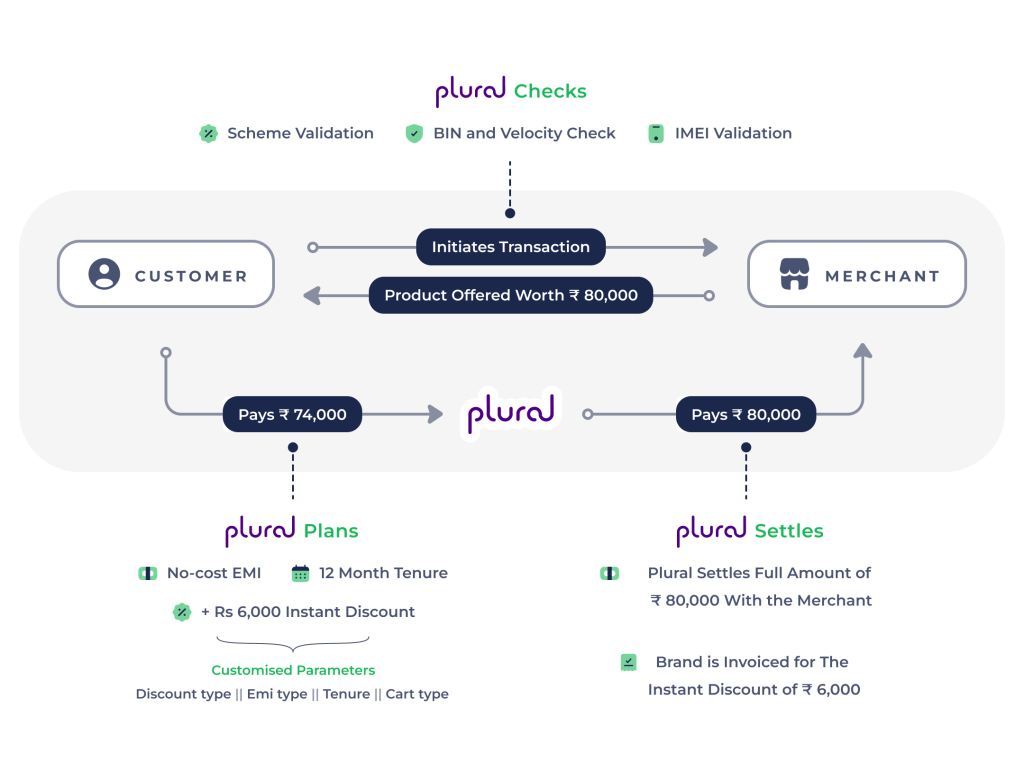

The Plural Advantage in Brand EMI backed by Pine Labs

As a pioneer and leader in the Brand EMI space, Pine Labs has carved out a unique position in the market. As part of the Pine Labs family, Plural leverages this advantage. Here’s why our offerings stand out:

Simplified Offer Configuration

We absorb the complexity of offer configuration, providing a simplified process for brands. Our offer engine considers 9 key attributes, each with multiple options, allowing for a wide range of permutations and combinations. This enables brands to tailor offers based on their arrangements with issuers and merchants.

Key offer components:

- Cashback Type: Instant and deferred

- Order Type: Single cart, Multi cart

- Subvention Type: Pre, Post, and instant subvention

- EMI Type: No Cost EMI, Low Cost EMI, Standard EMI

- Card Type: Credit Card, Debit Card, Cardless

- Issuer Type: Bank or NBFC

- Funding Combination: Combination of Bank + Brand + Merchant

- Tenure: 3 to 24 months

- Customized subvention plan: Split EMI, Down payment + EMI

Extensive partnerships

With 750+ enterprise customers, 9.9M transactions, and ₹250B worth of transactions, our platform boasts 25+ banking partnerships and 20+ global brand partnerships.

Omni-channel synergies

We offer seamless rewards across all channels, both offline and online, allowing brands and merchants to maximize their reach.

Flawless reconciliation

Our T+1 settlement programs ensure working capital optimization. We handle everything from loan booking with issuers to customized settlement reports, brand invoicing, and cashback posting.

Long-term relationships

Our years of relationships with banks and brands have led to deep integrations, enabling real-time validations and eligibility checks. This includes everything from TID Approval and mapping to Cardless EMI and Loan Booking APIs.

How is Pine Labs shaping the future of Brand EMI?

At Pine Labs, we’re not just participating in the EMI and BNPL market; we’re leading it. Our vision is crystal clear: to create a seamless and efficient platform that empowers everyone—customers, merchants, and issuers alike. We’re not just eyeing new customer acquisition; we’re setting the stage for it by continuously integrating more brands and issuers. We’re also elevating the user experience to unprecedented levels.

Streamlining processes

We’re not planning to streamline booking and scheme configuration; we’re already on it. Our relentless focus on minimizing drop-offs and optimizing order values is not a goal but a commitment. Financial accessibility isn’t just an aspiration; it’s a promise we intend to keep.

Our game-changing Initiatives

- Affordability as a Service – We’re not just offering features; we’re revolutionizing affordability itself. From SKU-level item management to eligibility and velocity checks, we’re making it all a standalone service. Our Loan Booking Suite isn’t an add-on; it’s a game-changer in easy settlements.

- Self-serve offers engine and dashboard – We’re handing the reins over to brands with our self-serve offer configuration interface. Instant offer activation and real-time spend visibility aren’t features; they’re standard. Our dashboard doesn’t just show data; it offers actionable insights

- Promotions recommendation engine – We’re not just storing data; we’re turning it into actionable insights. Our analytics don’t just evaluate performance; they shape future strategies. We’re not just offering recommendations; we’re ensuring you get the maximum benefits.

We’re not just shaping the future of Brand EMI; we’re setting the standard for it. With Pine Labs, the future isn’t just bright; it’s brilliant.

Amrita Konaiagari is a Marketing Manager at Plural by Pine Labs and Editor of the Plural blog. She has over 10 years of marketing experience across Media & Tech industries and holds a Master’s degree in Communication and Journalism. She has a passion for home décor and is most definitely a dog person.