With mounting privacy concerns about online shopping and increased awareness about how user information is handled, shoppers hesitate to save their cards while purchasing online for several reasons:

1. Security concerns: Customers worry about the security of their card details and potential unauthorized access if saved on a website.

2. Privacy: Some shoppers prefer not to store personal financial information to maintain their privacy and reduce the risk of data breaches.

3. Lack of trust: Trust issues with the website or concerns about how their data will be used may deter customers from saving their card information.

4. Unfamiliar platforms: Shoppers are hesitant to save cards on platforms they are not familiar with or do not consider reputable.

5. Preference for control: Some customers prefer entering card details for each transaction to have more control over their payment information.

6. Awareness of alternatives: Customers are aware of alternative secure payment methods and opt for those instead of saving card details.

7. Previous negative experiences: Past incidents of security breaches or unauthorized transactions may make customers reluctant to save their card details.

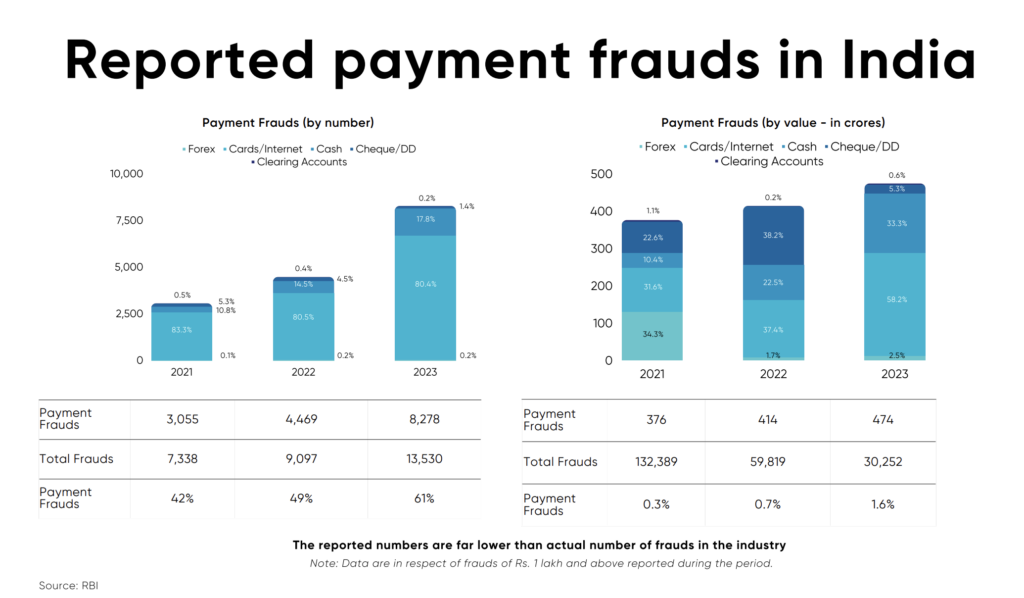

Payment fraud in online payments

In an era dominated by digital transactions, the surge in online payment fraud has been a pressing concern for both consumers and businesses alike. According to the Reserve Bank of India (RBI) statistics for FY2023, the volume of digital payments witnessed a remarkable 57.8% growth, accompanied by a 19.2% increase in value. However, this growth has been shadowed by a corresponding rise in fraud cases, with nearly 49% of the total reported cases attributed to digital payments. Globally, fraud rates have been soaring, with a 60% increase since 2017, doubling the attempts of retail fraud annually.

The implications of these statistics are clear: as digital transactions become more prevalent, the risks associated with fraud and breaches escalate. Recognizing this challenge, the RBI has mandated the adoption of card tokenisation as a proactive measure to enhance security across payment networks, banks, and other stakeholders.

Evolution of Securing Card Transactions: From Card on File (CoF) to Card on File Tokenisation (CoFT)

Before the advent of tokenisation, card transactions primarily relied on two methods: manual entry of card details for each transaction and Card on File (CoF), which enabled users to store their card information with merchants for future purchases. However, the introduction of Card-on-File Tokenisation (CoFT) marked a significant advancement in transaction security. CoFT ensured that card details were stored and transmitted as unique tokens, linked securely to specific merchants, thus mitigating the risks associated with storing sensitive information.

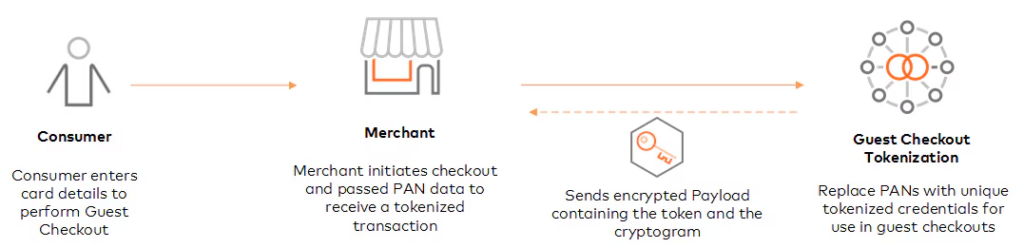

Despite the implementation of tokenisation, a notable proportion of users remained hesitant to save their card details, citing concerns regarding security and trust. This hesitancy paved the way for Guest Checkout Tokenisation (GC), offering a seamless alternative that ensures transaction security while eliminating the need for users to save their payment details.

Understanding Guest Checkout Tokenisation

Guest Checkout Tokenisation enables merchants and Payment Service Providers to tokenise Primary Account Numbers (PANs) entered by consumers during guest checkouts. Unlike traditional methods, Guest Checkout allows cardholders to make purchases without creating an account or saving their payment details with the merchant. This approach not only enhances security but also streamlines the checkout process, minimizing friction and potentially reducing cart abandonment rates.

Let’s delve into this scenario using a real-life example, particularly focusing on securing transactions with us. Imagine a customer visiting your website and proceeding to make a payment without choosing to save their card details for future use. Here’s how the process works:

1. The customer’s card details are securely transmitted to the Payment Gateway.

2. The Payment Gateway acts as the token requester (TR) and generates a unique token for the customer’s card with the respective card network (like Visa, Mastercard, Rupay, Diners, etc…).

3. Instead of sharing the actual card details, the Payment Gateway utilizes the generated token along with a dynamic cryptogram (which changes with every transaction) provided by the card network. This combination is used to initiate the payment process with the acquirer (the entity that processes the payment) and subsequently with other intermediaries like the card network.

4. By utilizing tokenisation, the token requester (TR) ensures that sensitive card details are not exposed to any of the intermediary parties involved in processing the transaction. This significantly reduces the security risks for the end customer, safeguarding their financial information throughout the payment journey.

In summary, by employing tokenization, we provide an additional layer of security for transactions, ensuring peace of mind for both merchants and their customers.

The Mechanism Behind Guest Checkout Tokenisation

When a consumer opts not to save their card details during a transaction, the card information is securely transmitted to the network to generate a token, utilizing robust encryption methods. This token replaces the actual card details and is accessible to all entities involved in the transaction, ensuring end-to-end security.

Benefits of Guest Checkout Tokenisation

1. Transaction Security: Enhances security through the use of cryptograms, safeguarding sensitive card information.

2. Cardholder Experience: Provides the benefits of tokenisation without the need to save card details, offering a seamless checkout experience.

3. Merchant Success: Reduces friction during guest checkouts, potentially lowering cart abandonment rates and enhancing overall customer satisfaction.

Introducing Plural Tokeniser

Our Guest Checkout solution, Plural Tokeniser, prioritizes the security of cardholders during online transactions. By implementing an Alternate ID system, we enable customers to input their complete card details for transaction processing without storing sensitive information on merchant websites. Our solution integrates seamlessly with major card networks, including VISA, MasterCard, RuPay, and Diners ensuring compliance with RBI guidelines.

Interested in learning more about how it operates and how to integrate? Click below to get in touch with our team.

Conclusion

As digital transactions continue to proliferate, ensuring the security and integrity of online payments is paramount. With Guest Checkout Tokenisation, Plural is at the forefront of innovation, offering a robust solution that not only enhances security but also elevates the overall payment experience for consumers and merchants alike. Embracing these advancements is essential in navigating the evolving landscape of digital payments and safeguarding against emerging threats. To know more about how Plural’s Tokeniser can help your business, click here.

A seasoned Senior Product Manager at Plural by PineLabs. With more than 11 years of expertise in fintech, specializing in digital payments and consumer lending, Kartik brings a wealth of experience in product building and shipping. He holds a Master’s degree in Information Technology Management, complementing his hands-on industry knowledge. Beyond his professional pursuits, Kartik is fueled by diverse passions including painting, cooking, and workout and cricket.