Most people know the basics of using a credit card, but the inner workings of credit card companies’ revenue generation remain a mystery. These companies are more than just transaction facilitators—they’re intricate businesses with multiple income streams and diverse customer types. This blog unpacks the mechanics of credit card companies, exploring their revenue models, customer personas, and the challenges they face in a competitive market. Let’s delve into what keeps these financial giants profitable and resilient.

Revenue Streams for Credit Card Companies

Credit card companies primarily earn through two main revenue streams: interest income and fee income.

Interest Income

- Revolving Balances: Interest from cardholders who do not pay their full balance by the due date.

- Cash Advances: Higher interest charges on cash withdrawn using credit cards.

- EMI Conversions: Interest on amounts converted into instalment payments.

- Penalty Interest Rates: Additional interest charges for missed payments or violations of credit terms.

Fee Income

- Merchant Discount Rate (MDR): A fee charged to merchants when a card is used for payment.

- Late Fees: Penalties for delayed payments.

- Membership/Renewal Fees: Annual fees or joining fees for cardholders.

- Cash Withdrawal Fees: Charges for using a credit card to withdraw cash.

- Over-limit Fees: Fees charged when cardholders exceed their credit limit.

- Foreign Transaction Fees: Fees charged for transactions made in a foreign currency.

Understanding the Customer Personas Served by Credit Card Companies

Customer Persona

- Transactors: These customers pay their bills on time, avoiding interest charges.

- Revolvers: These individuals delay their bill payments, incurring interest charges.

- EMI Customers: These users convert their bills into Equated Monthly Installments (EMIs).

Customer Contribution to Revenue

- Transactors: Credit card companies earn primarily from MDR fees since these customers pay their balances in full each month.

- Revolvers: Companies earn from MDR fees and interest on delayed payments.

- EMI Customers: Revenue comes from MDR fees and interest on EMI conversions.

While all customers might be subject to annual fees, these charges can vary.

Balancing Risk and Profitability

- Transactors: Least risky but also the least profitable.

- Revolvers and EMI Customers: Higher risk due to potential defaults but contribute significantly to revenue.

Maintaining a balance between these customer types is crucial for credit card companies to ensure portfolio quality and steady revenue streams.

Expenses in the Credit Card Business

Operating a credit card business involves significant expenses, including:

- Marketing and Engagement Costs: Acquisition, marketing, and rewards redemption costs.

- Tech-Based Costs: Payments to networks like VISA and MasterCard, payment gateways, and other operational expenses such as employee salaries, sourcing, onboarding, collections, and recovery costs.

- Credit Costs: Higher delinquency rates due to the unsecured nature of credit cards.

- Financial Costs: Interest on borrowings, as financial companies need capital to operate.

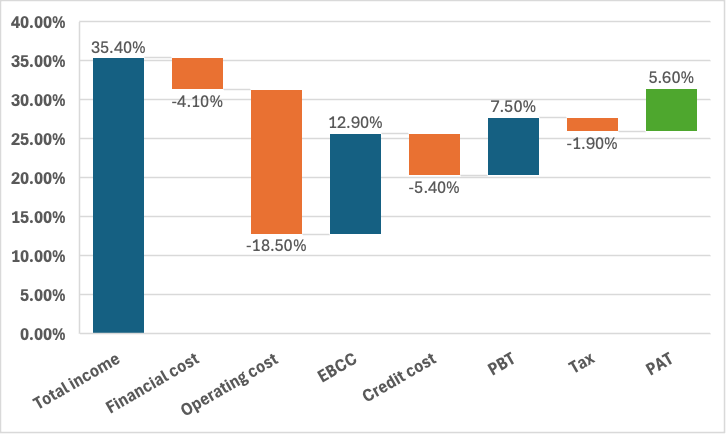

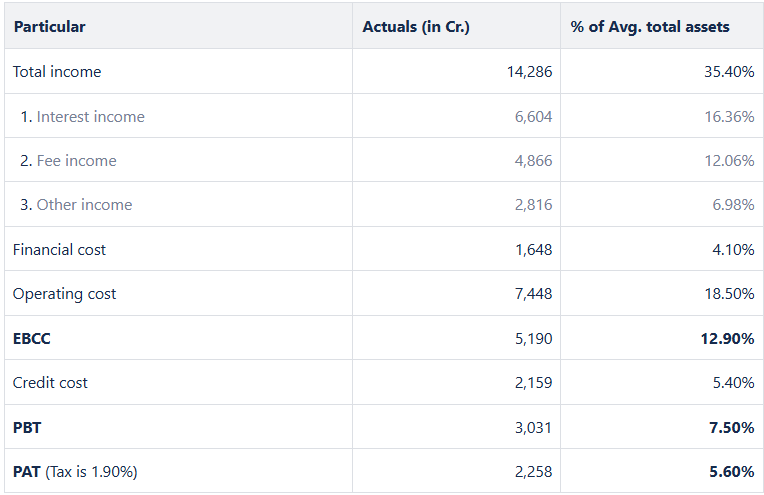

Breakdown of SBI Card’s Profitability: ROA Tree Analysis

For FY 2023, the ROA (Return on Assets) tree as a percentage of average total assets for SBI Card offers an in-depth analysis of how different factors contribute to the company’s profitability.

(Note: This is not an investment advice for SBI Card)

Market Disruption by New Players

New entrants are shaking up the market by:

- Reducing Credit Costs: Utilizing advanced credit models and analytics to minimize defaults.

- Lowering Operating Costs: Implementing scalable technology solutions.

- Enhancing Customer Experience: Offering better customer service and attractive discounts to gain market share, though high discounts may not be sustainable long-term.

Challenges for New Players

Despite their innovations, newer companies face significant challenges:

- Lack of Scale and Experience: They don’t have the operational scale or history of established players, leading to higher interest costs.

- Reliance on Equity Funding: Much of their growth depends on equity funding, and their business models remain unproven if this funding dries up.

In summary, credit card companies generate revenue through a blend of interest and fees, with different customer segments contributing uniquely to these streams. As they juggle high operating costs and credit risks, these companies must continually balance risk and profitability to thrive in a competitive landscape. New market entrants are introducing innovations but face significant challenges in sustaining growth. By facilitating efficient transactions and offering diverse payment options, Plural enhances the profitability and customer reach of credit card companies, enabling them to remain competitive and responsive to market dynamics.

A seasoned Senior Product Manager at Plural by PineLabs. With more than 11 years of expertise in fintech, specializing in digital payments and consumer lending, Kartik brings a wealth of experience in product building and shipping. He holds a Master’s degree in Information Technology Management, complementing his hands-on industry knowledge. Beyond his professional pursuits, Kartik is fueled by diverse passions including painting, cooking, and workout and cricket.