In 2010, a man from Florida spent 10,000 Bitcoins to purchase pizza and created history by making the first-ever commercial transaction using a cryptocurrency.

At that time, using cryptocurrencies for payments was unheard of, and Bitcoin was mainly considered a speculative asset. However, times have changed, and today, a growing number of businesses are accepting cryptocurrencies like Bitcoin as payments to gain a competitive edge.

According to a recent report by Deloitte, 85% of retailers across the globe are considering cryptocurrency as a payment option. Major businesses like Microsoft, PayPal, and Starbucks allow you to pay for your items in digital currencies. However, we’re yet to see many local Indian businesses accepting crypto for payments.

What is cryptocurrency, and how does it work?

Cryptocurrency is a type of digital currency that uses cryptography for security. Cryptocurrencies are based on blockchain technology, meaning they operate in a decentralised system. No central authority or intermediary (like a bank) controls the system in such a scenario. Instead, a distributed group of nodes runs the system, ensuring no single entity can exploit or tamper with the data.

As there’s no intermediary, crypto transactions are usually processed within minutes and have lower transaction fees than traditional payment methods. Cryptocurrency payments are also highly secure due to the advanced encryption techniques.

State of cryptocurrency payments in India

Crypto payments have been gaining momentum globally, with many retailers expecting it to revolutionise the payments market. Cryptocurrency payments offer significant benefits over traditional payment methods, primarily the lower cost of domestic and international transactions.

Unsurprisingly, many enterprises now support blockchain-based payments, and the pace of adoption is expected to increase. For example, the number of crypto payment users in the US is expected to rise to 5.5 million in 2023, indicating a 350% increase over three years. According to the report by US Faster Payments Council and Ripple, remittances are expected to remain the most mature use case, followed by B2B cross-border payments.

Digital payments are also getting popular in India as the digital rupee gains ground, but the future of cryptocurrencies remains to be determined. While accepting Bitcoin or another crypto for payments in India is possible, no rules or regulations govern these transactions. The government doesn’t consider crypto a legal tender, and accepting payments in crypto can be challenging at the moment.

The digital rupee is a tokenised digital version of the Indian rupee issued by the Reserve Bank of India. It is accepted as a legal tender. On the other hand, cryptocurrencies are decentralised and not backed by any bank or intermediary. The digital rupee may offer some of the benefits of cryptocurrency payments, but the government has greater control over the digital rupee and its usage. Cryptocurrencies are not subject to control or manipulation by any central authority.

What are the risks and benefits of cryptocurrency payments?

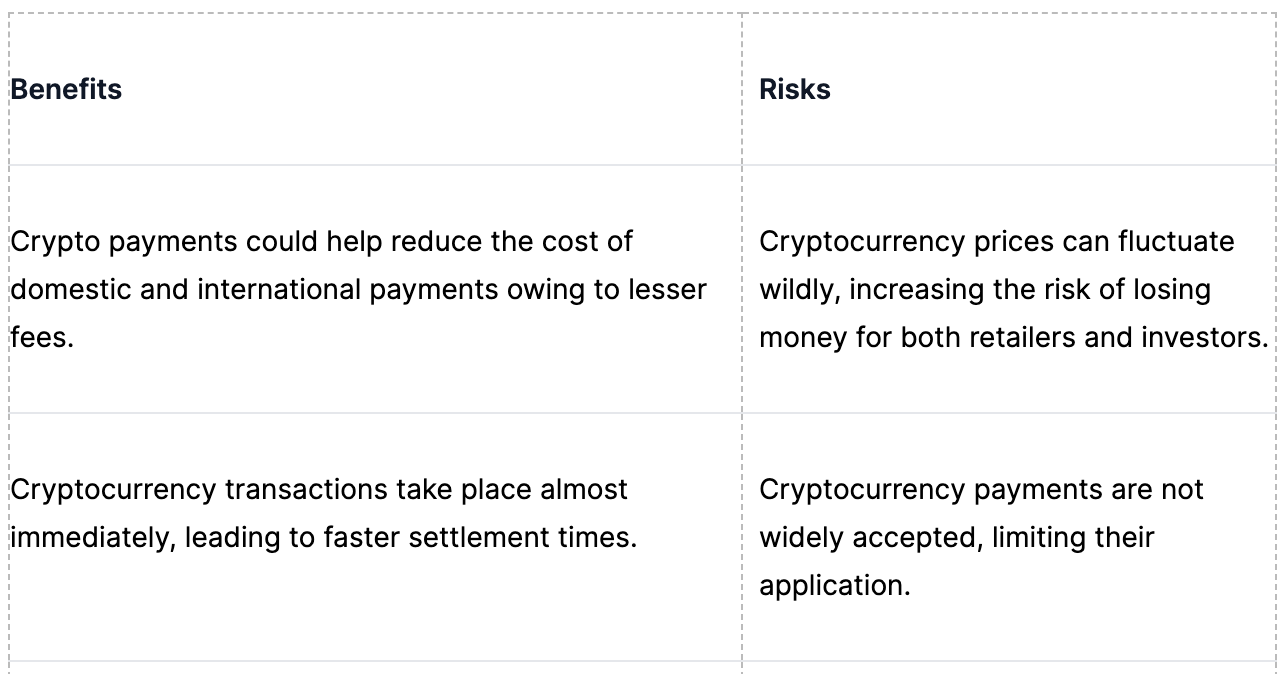

Cryptocurrency payments could offer a faster and cheaper alternative to traditional payment methods, but risks may be involved. Understanding the pros and cons of cryptocurrency payments could help you make an informed decision on whether you should accept cryptocurrency for payments as a business.

Even customers can benefit from understanding the pros and cons of using digital currencies for payments.

Future of cryptocurrency payments in India: parting thoughts

Even though the future of cryptocurrency payments in India is uncertain, we can’t deny the potential benefits of using digital assets for payments, such as faster transaction times, lower fees, and increased security.

Cryptocurrencies can also be accessed by the country’s unbanked population, allowing them to transact digitally even if they don’t qualify for traditional payment methods like debit or credit cards. However, the acceptance of cryptocurrency as a payment mode is currently limited in India. This is largely due to the unclear regulatory framework in which cryptocurrencies operate, as well as low awareness.

Crypto governance remains to be seen, but crypto payments can become popular once integrated with known payment methods, like mobile wallets. Meanwhile, businesses seeking simple and secure online payment solutions can explore Plural’s user-friendly payment gateway and other services here.

Amrita Konaiagari is a Marketing Manager at Plural by Pine Labs and Editor of the Plural blog. She has over 10 years of marketing experience across Media & Tech industries and holds a Master’s degree in Communication and Journalism. She has a passion for home décor and is most definitely a dog person.