Today’s customers expect convenience above all when it comes to everyday life, which is why Buy Now Pay Later’s popularity is a big topic of discussion in today’s landscape. This very need is one of the driving factors behind the growth of the e-commerce industry, which is now an industry over 5.7 trillion dollars as of this year.

If you are an e-commerce business, one of the key metrics you should focus on to improve your bottom line is minimising cart abandonment. On the other hand, if you are a business looking to offer additional payment methods to your customers, one strategy that has gained significant traction in recent years is Buy Now, Pay Later (BNPL).

In short, BNPL is a payment method that gives your customers the convenience and flexibility to get what they want now in the form of a microloan or spread out the cost of their transactions over time and pay for it at a later date, often without incurring any interest.

This blog will dive into Buy Now Pay Later’s popularity with businesses and customers and walk you through how to incorporate BNPL into your business strategy.

How BNPL Can Benefit Your Business

Buy Now Pay Later’s popularity is on the rise, and for a good reason – its implementation brings along with it a host of benefits, such as:

Convenience for Consumers

One of the paramount benefits of implementing BNPL into the list of payment options you offer to your customers is convenience. With BNPL, your customers no longer have to pay a large sum of money on the spot to buy your product or avail of your service.

This only overcomes the financial barrier that may be holding back customers from making that purchase but also helps them avoid paying additional interest that comes along with other forms of payment options.

Marketing and Promotions

As a business, you can capitalise on Buy Now Pay Later‘s popularity and use it in all of your marketing and promotion campaigns.

As a result, you will also attract a new pool of customers who may not be able to afford your services upfront but also help bring down your cart abandonment rates buy a significant margin.

As a business, BNPL will also facilitate spending larger sums in one go. The flexibility will encourage your customers to add additional items to their carts, resulting in higher average order values, further improving your bottom line.

Influence on Consumer Behavior

BNPL can also have a positive impact on consumer behaviour and satisfaction. BNPL can help customers overcome the psychological barrier of spending a large amount of money in one go, which can lead to buyer’s remorse or regret.

Allowing customers to pay later will help customers feel more confident and comfortable with their purchases. It will also help businesses build customer loyalty and retention, as customers are more likely to return to a business that offers them convenience and flexibility.

The Popular Buy Now Pay Later Providers in India

India’s vibrant BNPL landscape boasts numerous players, each vying for a slice of the rapidly growing market. Among the frontrunners are:

Simpl

Renowned for its seamless checkout experience and vast network of merchant partners, Simpl offers flexible payment options for online and offline purchases.

ZestMoney

Catering primarily to high-ticket items, ZestMoney provides instant credit approvals and longer repayment tenures, making it a popular choice for consumers seeking flexibility in terms of payment options.

LazyPay

Backed by the e-commerce giant Paytm, LazyPay enjoys a significant market share thanks to its user-friendly interface and integration within the Paytm ecosystem.

Flexmoney

Focusing on B2B partnerships, Flexmoney empowers businesses to offer BNPL solutions to their customers, enhancing their sales and customer experience.

Plural by Pine Labs

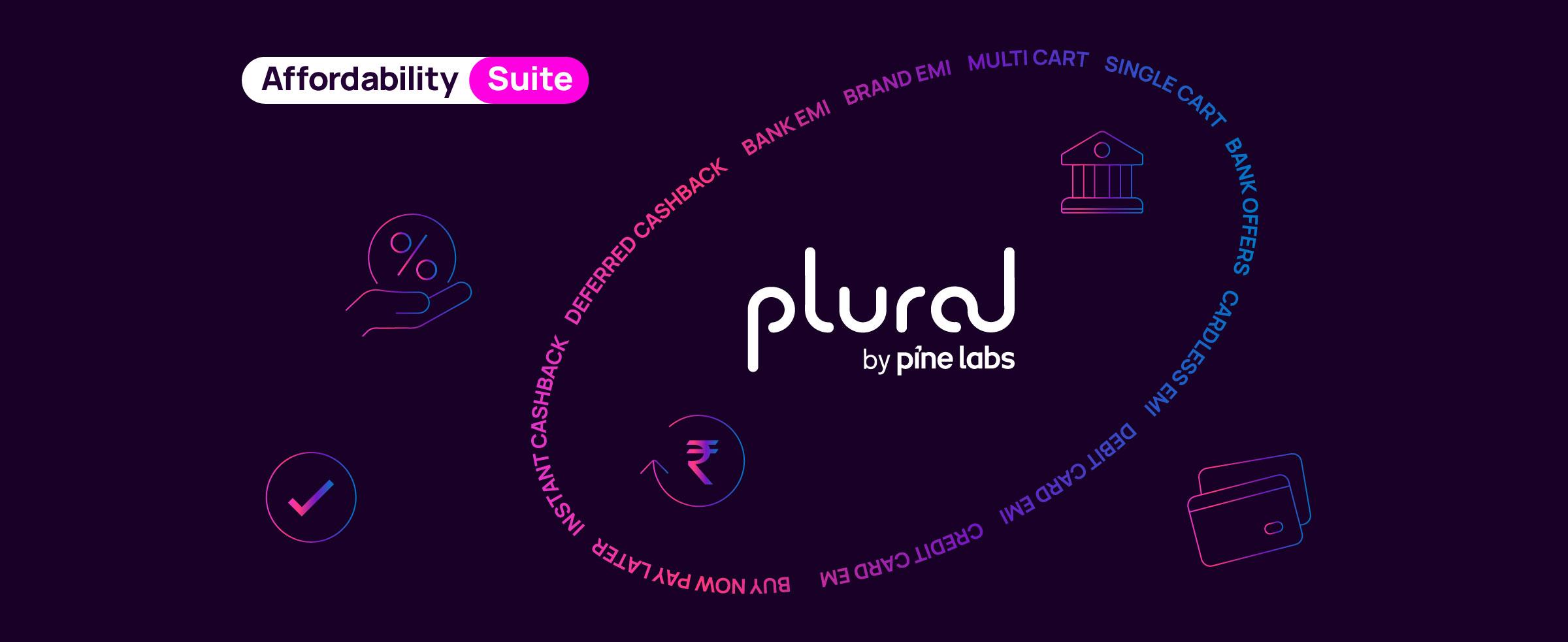

Emerging as a force to be reckoned with, Plural by Pine Labs offers a seamless and secure BNPL experience. Its instant credit approvals, and diverse payment options cater to a wide range of consumer needs. With our seamless, comprehensive solution equipped with over 100+ payment modes, get started on the BNPL experience in just a few clicks.

Future Trends in Buy Now Pay Later’s Popularity

The meteoric rise of BNPL shows no signs of slowing down. Based on Buy Now Pay Later’s popularity, as per the current forecast, India’s BNPL service market, which was valued at 1.1 billion as of 2022, will reach a staggering 4.6 billion by 2029 based on an estimated CAGR of 23.1%.

This rapid growth is fueled by various factors, including technological advancements and shifting consumer preferences.

Technological Advancements

One of the key factors influencing the future of BNPL is technological innovation. BNPL providers are leveraging cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), open banking, and blockchain to enhance their services and offer better value to their customers.

AI and ML enable BNPL providers to offer personalised credit assessments, fraud detection, and risk management. These technologies help BNPL providers make faster and more accurate decisions about loan approvals, tailor interest rates, and prevent fraudulent transactions.

The shift toward open banking will enable BNPL providers to integrate their services with existing bank accounts, enabling smoother and more seamless transactions. This technology will also give BNPL providers access to real-time data and offer customised offers and improved user experiences.

Industry Predictions and Forecasts

As Buy Now Pay Later’s popularity continues to soar and gain popularity, specifically among Gen Z and millennials, the government is considering implementing regulations to protect consumers and ensure financial stability. These regulations may include requirements for credit affordability assessments and information disclosure.

As the BNPL market matures over time, there is a likelihood of consolidation as smaller players are acquired by larger companies or merge to create more substantial entities.

This consolidation will lead to fewer players competing in the market, potentially affecting consumer choice and pricing. As is the trend with every industry today, there will also be a focus on sustainability in this sector.

BNPL providers will look for ways to integrate sustainability into their offerings, such as partnering with eco-friendly retailers or offering rewards for sustainable purchases.

Wrapping it up

As we conclude our exploration of the Buy Now Pay Later’s popularity, it’s evident that this payment option is, in fact, a game-changer for e-commerce businesses across the board.

As a business, adopting this payment option will reap many benefits, from increased sales to new customer acquisition and, most importantly, improved customer satisfaction – all of which will ultimately boost your bottom line.

If you seek to harness the power of BNPL, our Affordability Suite offers a comprehensive solution to seamlessly integrate this payment option into your operations. Our suite provides many tools and services to help you effectively manage BNPL transactions, optimise customer experience, and maximise your benefits with this integration.

Contact our sales team today to schedule a consultation and discover how BNPL can help you take your e-commerce business to the next level. Click below to get started.